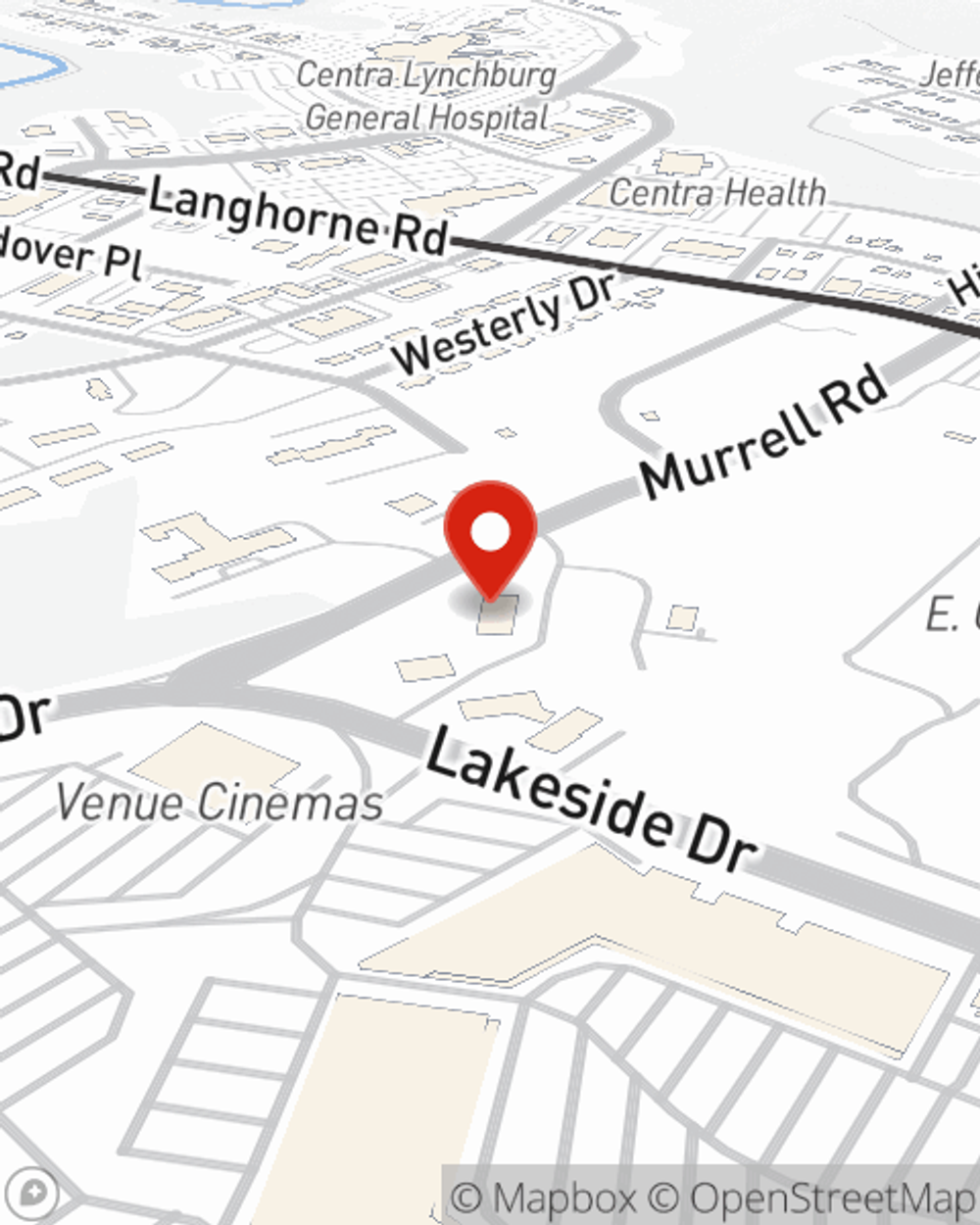

Business Insurance in and around Lynchburg

Lynchburg! Look no further for small business insurance.

This small business insurance is not risky

- Forest

- Amherst

- Brookneal

- Madison Heights

- South Boston

- Campbell County

- Bedford County

- Amherst County

Your Search For Great Small Business Insurance Ends Now.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Ben Hildreth. Ben Hildreth gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Lynchburg! Look no further for small business insurance.

This small business insurance is not risky

Small Business Insurance You Can Count On

If you're looking for a business policy that can help cover loss of income, computers, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Visit State Farm agent Ben Hildreth's team today with any questions you may have.

Simple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Ben Hildreth

State Farm® Insurance AgentSimple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.